TIF Abuse

Tax Increment Financing (TIF) allows governments to borrow against future tax revenue in order to incentivize development in an area that would otherwise not be developed. According to the statutes outlined below, the borrowed tax revenue must benefit the Tax Increment District (TID) from which the future tax revenue was borrowed.

On May 11th, the City of Altoona, WI amended the Project Plan for Tax Incemental District (TID) No. 3 (Agenda, Video, Minutes). They did this in order to appropriate $1.6M in taxpayer money to extend utilities from Altoona Elementary to a future planned development (both lie outside of TID No. 3).

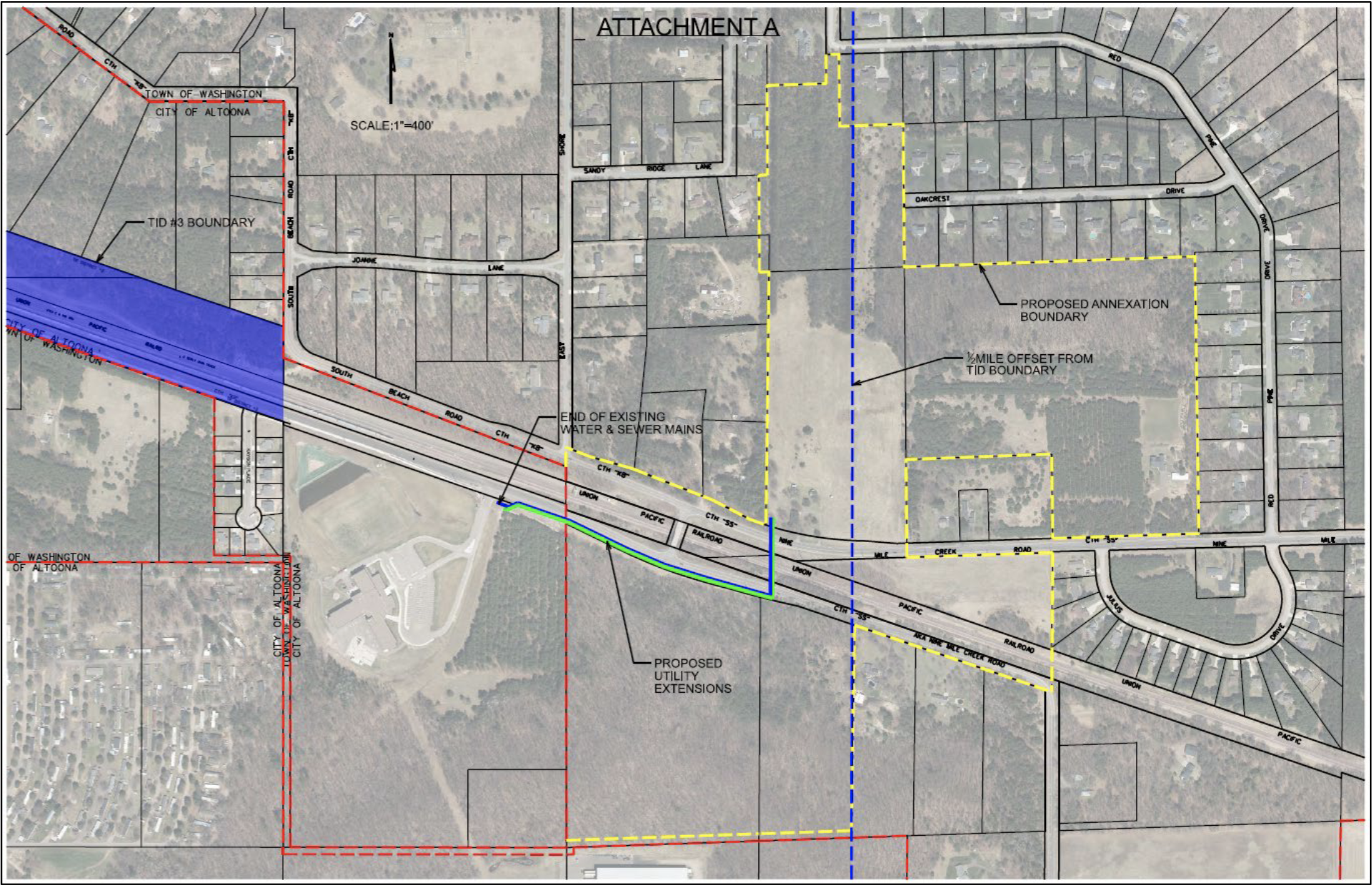

Important elements of the map:

- Solid blue and green lines in the middle show the planned location of the sewer and water utility extensions

- Blue shaded area to the left is the eastern edge of Altoona TID No. 3 and is owned by Union Pacific Railroad

- Blue dashed line down the middle shows one half-mile from TID No. 3

- Yellow dashed line shows the land that was annexed into Altoona

Wisconsin § 66.1105(2)(f)1 states (emphasis added):

only a proportionate share of the costs permitted under this subdivision may be included as project costs to the extent that they benefit the tax incremental district

The statutory definition of “[TID] project costs” is pretty clear. In order to fund a project with money from TID No. 3, the project must benefit TID No. 3. The beginning and end of the sewer connection lie outside of Altoona TID No. 3. Futhermore, no part of the sewer connection would go through TID No. 3. The proposed sewer extension cannot possibly benefit Altoona TID No. 3.

Altoona seems to think that Wisconsin § 66.1105(2)(f)1n grants them carte blanche to do anything within one half-mile of TID No. 3. However, the greater definition of “project cost” (Wisconsin § 66.1105(2)(f)1) still states that “only a proportionate share of the costs … may be included as project costs”.

The project solely benefits developer. No part of this utility extension benefits Altoona TID No. 3 and it’s plain to see that pursuing this as a “project cost” is unlawful and a waste of taxpayers money.